I had a few recent discussions that involved the theoretical math behind portfolio projections and expected profits (or losses). In such situations, instead of guessing or pulling numbers out of a hat, I generally do the actual math before coming to a final conclusion.

So over the last few days when I’ve gotten tired of going through the master domain lists to produce my daily lists here at NameCult, I switch over to a growingly complex Excel spreadsheet I’ve been developing that completely pulls apart all the numbers and puts them back together to give a long term portfolio projection of when you’ll reach ONE MILLION DOLLARS based on your current buying habits and average sales.

WARNING: This is just THEORETICAL MATH, because domaining is very random and while it most certainly does involve skill, there’s no denying that luck is also a very big factor.

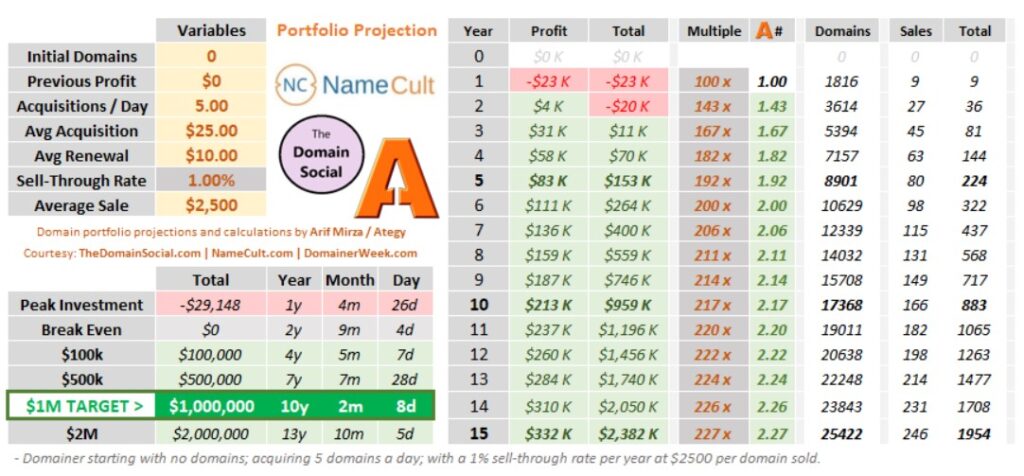

So let’s jump into a first example In this case we’ll be assuming a new domainer (starting with zero domains) buying 5 domains a day at the average price of $25 per domain (including renewal) with a average renewal cost of $10 and a sell-through rate of 1% with domains priced at $2500:

As you can see, the final projection shows the domainer will reach ONE MILLION DOLLARS in 10 years and 69 days. More importantly, on the way to that goal, the most the domainer will ever be out of pocket is $29,148 (after about a year and half).

Their first year will be a loss (of $23k), but as their “per domain” cost goes does down their profits slowly start to climb (remember the first year is the $25 acquisition, but all subsequent years the only cost is the $10 renewal). Their second year will still continue into more losses peaking at -$29.1k after 15 months of domaining, but they will actually finish that year with a tiny profit (of $4k) for a running total of about -$20k. By the end of their 3rd year they’re out of the red and actually have $11k in overall profits. They hit $100k in 4.5 years after they started, and then reach $500k 3 years after that. Finally hitting the $1M mark after selling 916 of the 18,595 domains acquired in just over 10 years. The 2nd million only takes about 3.5 years after the first million!

Two main things happen over time:

1 – Your sales velocity increases as your portfolio grows.

2 – Your costs per domain slowly diminishes as the percentage of “domains in your portfolio that were new acquisitions within the previous year” vs “domains in your portfolio that only the cost renewal” decreases. Which effectively is all about the fact your first year cost of a domain is usually much higher than every year after that when you only need to pay renewals.

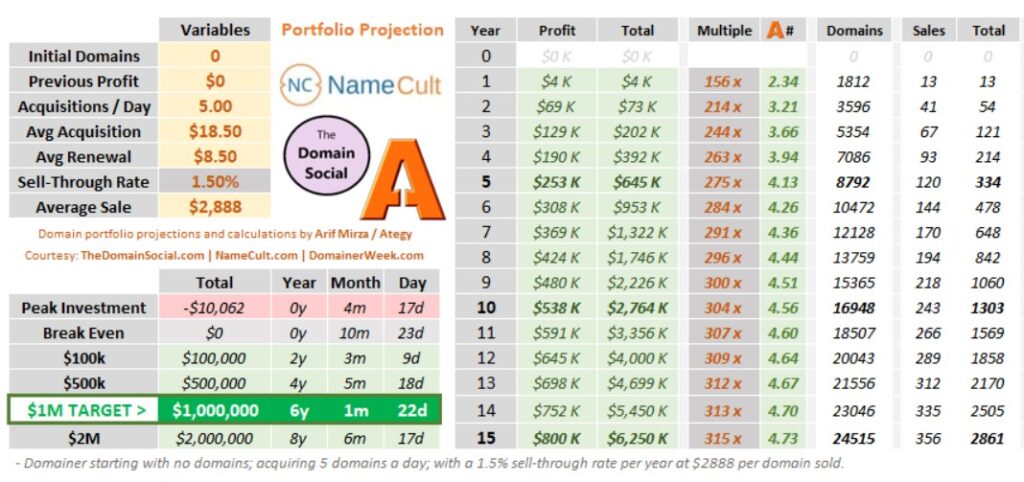

Now let’s jump to our headline example of the math behind reaching $1,000,000 in just 6 years with only $10,000 in costs:

Here we’re still assuming a domainer with no initial domains. Someone buying a 5-pack of closeout domains per day at an average cost of $18.50 ($11 closeout +$8.50 renewal -$1.00 with a five-pack discount).

To achieve this, the domainer in question would need to be noticeably more skilled at finding value in domains than the domainer in the previous example. Because now we’re assuming a 1.5% annual sell-through rate with an average sale of $2,888.

What’s really notable here is how fast the portfolio goes into the green. The peak investment in this case is $10,062 after only 4.5 months. After that the domainer breaks even before the end of the first year and reaches $100k in total profits after 2 years and 3 months. They’ll hit $500 in 4.5 years, and then the ONE MILLION DOLLAR mark in just over 6 years.

Here are some important assumptions I’ve incorporated in the calculations and math:

1 – I kept it conservative and timed sales at the END of the average sales period (in theory the statistical average would be in the middle).

2 – I tweaked the math so that there are no renewals on new domains for year 0. Beyond that renewals are effective accurate as I’ve averaged out the point in the renewal cycle of sold domains.

3 – I didn’t account for Leap Years, interest or inflation. For the last two it would be different for each domainer based on where they got their funds and where they live.

4 – The average acquisition costs INCLUDES renewal (for expired domains). If you acquire mostly non expired domains, then you need to add the cost of one renewal and then subtract the prorated amount before the next renewal.

5 – This also obviously does NOT take into consideration that the quality of your domain acquisitions increase over time (which would be effectively impossible to quantify into math, as everyone is very different in that regard).

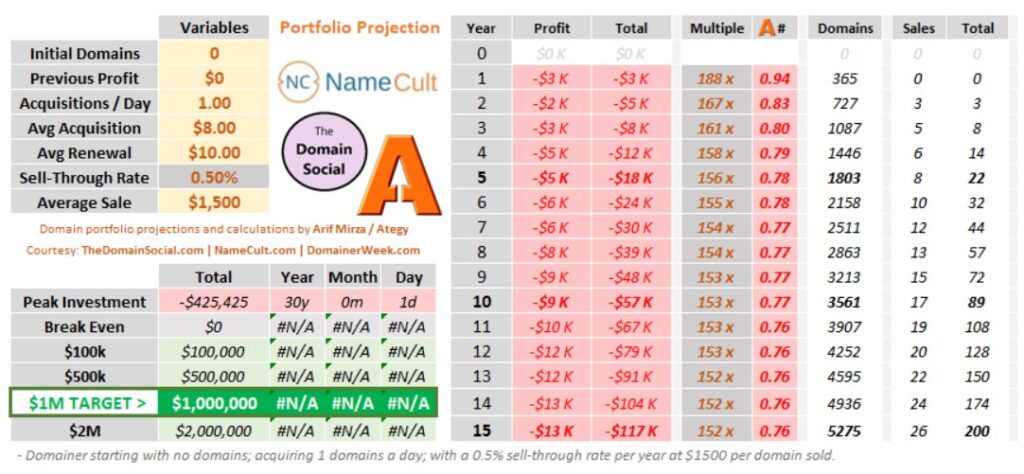

So that now you’ve seen one good and one excellent projection, I also feel it’s important to post a negative one:

Here is an example of a new domainer acquiring mostly hand-registrations with a few discounts/coupons for an average acquisition price of $8, then and average of $10 for renewals as I’m assuming some non-.com’s. Because of the likely weaker domains, their average sell-through rate is only 0.5% with an average sales price of $1500.

In this scenario the domainer in question never reaches an inflection point where they start to turn towards profit. They just keep going deeper and into debt despite only buying 1 domain per day on average. After 10 years they’re $57k in debt (assuming they keep renewing, which admittedly they likely didn’t).

WARNING (yes again): All that said, these sales projections are purely theoretical! In the end while it’s great to see “average” results, it should be stated that domain sales are extremely random. Just because you have a 1% long term sell through, does not guarantee anything in the short term.

I hope this gives everyone a bit of insight into how the theoretical math involve with portfolio projections can be a helpful thing to know when trying to figure out if you’re on the right or wrong track in the long term.

All that said, there is no math that can truly help you get good domains that will actually sell. Branding is just as much art as it is science, and while being aware of the math and probabilities most definitely WILL help you be a better domainer, if you can’t grasp the linguistic and artistic aspects of choosing good domains AND purchase them at low enough prices that leaves you room for big multiple sales margins, then you are in big trouble before you even begin. Because while a 1% sell-through rate might sound easy, most new domainers never come close to that amount unless they drastically reduce their average sales price (which kills any chance of ever seeing any profits).

If there’s a scenario you’d like to see that resembles your style of domaining, please post in the comments and I’ll post your customised chart! 🙂

Thank a lot for this post. I have heard of similar strategies but never heard them in pure dollar sense. Very detailed and well explained. Thanks again.

Great read thanks domaining is no different from any other market it’s essentially probabilities numbers and sell through through rates with a million different ways to play the same game.

It would be great to see some scenarios for different extensions such as .io with higher aquisition and renewal costs.

Cheers

Thanks for the comment. I actually did a live session where people could submit their own numbers to plug into the spread sheet. Join us on the weekly Domain Socials, I’ll probably do it again at some point if enough people are interested! 🙂

Thanks for posting Arif